PENGARUH KONSERVATISME AKUNTANSI DAN INTENSITAS MODAL TERHADAP TAX AVOIDANCE DENGAN DEWAN KOMISARIS INDEPENDEN SEBAGAI VARIABEL MODERATING

Abstract

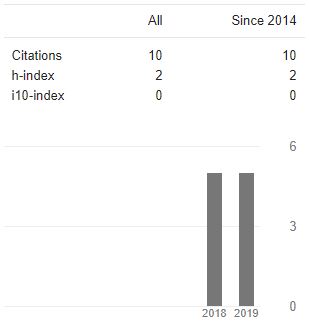

This study aims to provide empirical evidence that accounting conservatism and capital intensity affect tax avoidance, as well as the existence of an independent board of commissioners as a moderating variable to interact with the relationship between accounting conservatism and capital intensity on tax avoidance. This research is associative, sample selection is done by purposive sampling method. The data used are secondary data and annual reports, while the data analysis techniques used are descriptive statistical analysis and multiple regression analysis and for statistical analysis of moderating variables using the value test using SPSS 21.

The results of this study indicate that accounting conservatism has a significant negative effect on tax avoidance, while capital intensity has a significant and positive effect on tax avoidance. And the independent board of commissioners is able to moderate the effect of accounting conservatism on tax avoidance, while the independent board of commissioners is not a variable that moderates the effect of capital intensity on tax avoidance.

Keywords

Full Text:

PDFReferences

Adisamartha, I.B.P. Fajar dan Naniek, N. 2015. Pengaruh Likuiditas, Leverage, Intensitas Persediaan dan Intensitas Aset Tetap pada Tingkat Agresivitas Wajib Pajak Badan. E-Jurnal Akuntansi Universitas Udayana. ISSN: 2303- 1018. 13.3

Aditama, Ferry dan Anna Purwaningsih. 2014. Pengaruh Perencanaan Pajak Terhadap Manajemen Laba pada Perusahaan Nonmanufaktur yang Terdaftar Di Bursa Efek Indonesia. MODUS. 26. 1. ISSN: 0/;’’’’’’’;852-1875.

Agusti, Wirna Yola. 2014. Pengaruh Profitabilitas, Leverage, dan Corporate Governance terhadap Tax Avoidance. Jurnal Akuntansi. 2. 3. Al-Qur’an dan Terjemahannya.

Anggraini, fivi dan I. Trisnawati. 2008. Pengaruh Earnings Management terhadap Konservatisme Akuntansi. Jurnal Bisnis dan Akuntansi. 10. 1.

Annisa, N. Ayu dan L. Kurniasih. 2012. Pengaruh Corporate Governance terhadap Tax Avoidance. Jurnal Akuntansi dan Auditing. 8. 2.

Annisa, Nuralifmida Ayu. 2011. Pengaruh Corporate Governance Terhadap Tax Avoidance. Jurnal Akuntansi & Auditing. 8. 2.

Astrian, afri.,D.F. Puspa dan Ethika. 2015. Pengaruh Corporate Governance dan Konservatisme Akuntansi terhadap Tax Avoidance (Studi pada Perusahaan Manufaktur yang Terdaftar di BEI). E-Jurnal/Journal System. 6. 1.

Darussalam dan Danny Septriadi. 2009. Tax Avoidance, Tax Planning, Tax Evasion, dan Anti Avoidance Rule.

Artikel.http://www.ortax.org/ortax/?mod=issue&page=show&id=36&hlm=2. Diunduh tanggal 20 September 2016.

Delgado,F.J., Elena, F.J and Antonio, M.A. 2014. Effective Tax Rates in Corporate Taxation: a Quantile Regression for the EU. Inzinerine Ekonomika- Engineering Economics. 25. 5. 487–496.

Dwilopa, Dio Erlangga. 2016. Pengaruh Corporate Social Responsibility, Capital Intensity, dan Perencanaan Pajak terhadap Penghindaran Pajak. Naskah Publikasi. http://repository.umy.ac.id/handle/123456789/8328?show=full.

Dwimulyani, Susi. 2010. Konservatisma Akuntansi dan Sengketa Pajak Penghasilan: Suatu Investigasi Empiris. Simposium Nasional Akuntansi XIII. Purwokerto.

Ghozali. Imam. 2013. Aplikasi analisis Multivariate dengan Program SPSS, Edisi keempat. Semarang: universitas Diponegoro.

Gujarati. 2006. Damodar N (United States Military Academy, West Point). Essentials Of Economics. Third Edition. Mc Graw-Hill International Edition.

Gupta. S dan Newberry. K. 1997. Determinants Of The Variability In Corporate Effective Tax Rates: Evidence From Longitudinal Data. Journal of accounting and public policy. 1-34.

Haniati, Sari dan Fitriany. 2010. Pengaruh Konservatisme terhadap Asimetri Informasi dengan Menggunakan Beberapa Model Pengukuran Konservatisme. Simposium Nasional Akuntansi XIII. Purwokerto.

http://economy.okezone.com. Diunduh 22 September 2016.

DOI: http://dx.doi.org/10.53712/aktiva.v7i1.1578

Refbacks

- There are currently no refbacks.

Indexing:

Member Of:

Reference Manager:

Published by Prodi Akuntansi Fakultas Ekonomi Universitas Madura

Jl. Raya Panglegur Km 3,5 Pamekasan

Phone: (0324) 322231

website: http://ejournal.unira.ac.id/index.php/jurnal_aktiva/index

Email: jaa.unira@gmail.com

AKTIVA by Universitas Madura is licensed under a Creative Commons Attribution 4.0 International License.